Understanding Cash on Cash Return:

A Key Metric for Real Estate Investors

As a real estate investor, one of the most important metrics to understand is Cash on Cash Return (CoC Return). It’s a straightforward calculation that helps you assess the profitability of your investment property, making it a valuable tool when deciding whether to buy or sell in a dynamic real estate market. Whether you’re a first-time or an experienced investor, understanding Cash on Cash Return is essential to making smart investment decisions. In this blog post, we’ll explore what Cash on Cash Return is, how to calculate it, why it matters for investors, and how to use this metric to maximize your returns.

What is Cash on Cash Return?

Cash on Cash Return (CoC Return) is a simple metric that measures the return on investment (ROI) in relation to the actual cash you’ve invested into a property. Unlike other metrics like cap rate or total return, Cash on Cash Return focuses on the cash you’ve personally put into the property—whether it’s the down payment, closing costs, or other initial expenses. In short, it tells you how much cash you’re earning on the money you’ve spent on the property. This is particularly important for real estate investors in Austin, where high property values and competitive demand can make understanding your return on investment critical to long-term success.

How to Calculate Cash on Cash Return

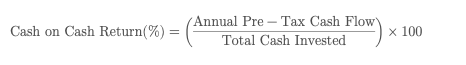

To calculate Cash on Cash Return, you can use this formula:

Where:

- Annual Pre-Tax Cash Flow is the rental income minus expenses (including mortgage payments, property taxes, insurance, and maintenance).

- Total Cash Invested refers to the total amount of cash you’ve put into the property, including the down payment, closing costs, and any repairs or renovations.

For example, if you invested $50,000 in a property and your annual pre-tax cash flow is $5,000, your CoC return would be 10%.

Why Cash on Cash Return Matters for Real Estate Investors in Austin

In Austin, where real estate values are continually appreciating, it’s vital for investors to track Cash on Cash Return to determine if their investments are profitable. Since the Austin market is highly competitive, understanding this metric helps you decide which properties are worth the investment and whether the returns align with your financial goals.

CoC Return also helps investors compare properties. While the Cap Rate gives you an overall snapshot of the potential return of a property, Cash on Cash Return focuses on the actual cash out-of-pocket, which can be more relevant for investors in understanding the return on the capital allocated to the investment.

Factors That Impact Cash on Cash Return

Several factors can influence your Cash on Cash Return, including:

- Financing Structure - if you use leverage (i.e., borrowing money for a mortgage), you’ll have less of your own cash invested, which can lead to a higher CoC return. However, more leverage means more risk, especially in a fluctuating market like Austin.

- Rental Income - the more rental income you generate, the higher your Cash on Cash Return. For example, the demand for Short-Term Rental (STR) investments is high in Austin, which can provide a solid cash flow if you’re able to capitalize on this trend.

- Operating Expenses - your CoC return will be impacted by the amount you spend on the property. If you’re spending a lot on repairs, property management, or utilities, it can negatively affect your profits.

- Appreciation - while Cash on Cash Return focuses on cash flow, it’s important to consider property appreciation over time, which can impact your returns when you sell the property.

Real-Life Example: Calculating Cash on Cash Return

Let’s say you purchase a rental property in Austin for $400,000 with a 25% down payment. You invest $100,000 in cash and finance the rest. Your property generates $2,500 in monthly rental income. After accounting for your monthly expenses (mortgage, taxes, insurance, maintenance), your annual pre-tax cash flow comes to $10,000.

In this scenario, your Cash on Cash Return is 10%, meaning you’re earning 10% annually on your $100,000 investment in cash flow.

Using Cash on Cash Return for Investment Decisions

Cash on Cash Return is a valuable tool when considering potential real estate investments. It provides a snapshot of how well a property is performing based on the cash you’ve invested. By calculating the CoC return for different properties, you can make data-driven decisions on which properties are the most lucrative for your investment strategy. For real estate investors, you might compare several properties to see which ones offer the highest returns. If you’re looking at properties in up-and-coming neighborhoods, Cash on Cash Return can help you assess whether the property is worth the investment.

Common Mistakes to Avoid with Cash on Cash Return

- Ignoring Other Costs - while Cash on Cash Return is helpful, it doesn’t account for long-term appreciation or tax benefits like depreciation. Be sure to consider the whole picture when evaluating an investment.

- Overestimating Rental Income - don’t assume that you’ll be able to achieve full occupancy or market rent right away. Account for potential vacancies and realistic rental rates when underwriting a property.

- Not Reassessing Your Investment Over Time - your CoC Return may change as your mortgage balance decreases, rental income increases, or operating costs change. Regularly reassess your investments to ensure you’re still on track to meet your financial goals.

Working with an Real Estate Agent to Maximize Your Return

As an experienced Austin real estate agent, I can help you identify investment opportunities in the Austin area that align with your financial goals. By leveraging the expertise of an agent who specializes in working with investors, you can make smarter investment decisions and maximize the Cash on Cash Return of your investments. Working with a local expert also ensures that you’re getting insights into emerging neighborhoods, off-market opportunities, and other factors that might affect your return on investment.